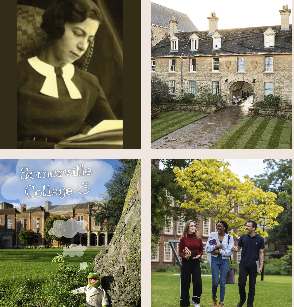

Graduating from Somerville isn’t the end of the story – far from it. As an alumna or alumnus of Somerville, you will always be a valued member of the Somerville community, joining a global network of endlessly curious and enthusiastic minds.

Alumni News & Events

Instagram

follow us